wells fargo class action lawsuit 2018

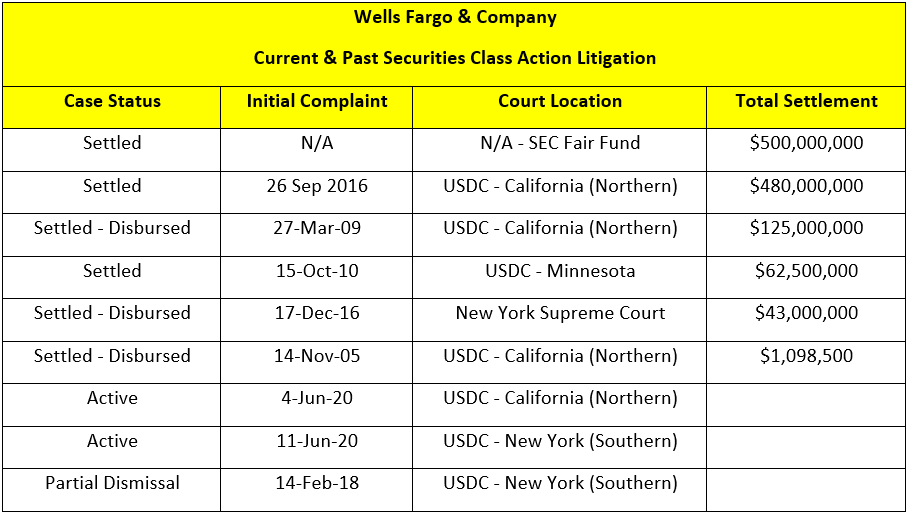

Along with the class action filed against Wells Fargo because of the unauthorized accounts opened under their existing customers name the bank was hit with another that claims they added car insurance coverage to existing car loan. Wells Fargo will pay 480 million to put to rest claims that the bank misled shareholders about its fake-accounts scandal.

Wells Fargo Must Face Shareholder Lawsuit Alleging Compliance Failures

This settlement resolves a lawsuit against Wells Fargo Bank NA Wells Fargo Co National General Holdings Corp.

. The lawsuit estimates as many as 13000 potential participants in the class-action suit including all Black people in the US. Wells Fargo home loan customers who lost their homes may be able to benefit from an 185 million settlement that if approved by the court will end a class action lawsuit alleging bank errors led to mortgage holders losing their homes to foreclosure. According to the lawsuit Wells Fargo is attempting to make things right by entering a 142 million settlement fund in.

Wells Fargo announced late last week that it has agreed to pay 480 million to settle a securities fraud class-action suit. And National General Insurance Company collectively Defendants alleging that between October 15 2005 and September 30 2016 Defendants unlawfully placed collateral protection insurance CPI policies on Class. A class-action lawsuit is underway against Wells Fargos home mortgage for denying qualified homeowners the ability to modify their loans.

According to the 26-page lawsuit defendant Michael W. Wells Fargo allegedly used its own software to calculate a borrowers eligibility for HAMP rather than use the tool developed by Fannie Mae for this exact purpose. Joshua Bloomfield prosecutes complex class action lawsuits with particular experience in data breachprivacy cases and antitrust matters.

Wells Fargo has committed to or already provided restitution to consumers in excess of 600 million through its agreements with the OCC and CFPB as well as through settlement of a related consumer class-action lawsuit and has paid over 12 billion in civil penalties to the federal government and to the City and County of Los Angeles. The Complaint can be read HERE. Beasleys trust account with Wells Fargo whos also named as a defendant served as the entry point to the scam which the case says was orchestrated by the Beasley firm Jeffrey Judd and his entities JJ Consulting Services Inc.

A Wells Fargo class action lawsuit payout can include several different things. Wells Fargo Mortgage Modification Lawsuit. In August 2018 Wells Fargo admitted that a software error caused it to deny hundreds of borrowers who actually qualified for and were entitled to a loan modification under HAMP.

If you recently noticed that Wells Fargo opened a checking savings credit card or line of credit account for you without your permission you may be eligible for a potential award from the Wells Fargo Unauthorized Accounts Class Action Lawsuit. July 2 2020 Whos Eligible. A class-action securities fraud lawsuit brought by investors alleged that.

January 21 2022. In November 2018 Wells Fargo revised its estimate announcing that the miscalculation actually affected 870 homes that were going through foreclosure between March 15 2010 and April 30 2018. In May Wells Fargo agreed to pay 480 million to settle a class-action securities fraud lawsuit brought by investors who alleged the bank made misstatements and omissions in its disclosures about.

The damages in the class action lawsuit are almost quadruple what Wells Fargo argued it should owe. The ruling applies to Wells Fargo mortgage consultants and bankers who worked at the bank in. Qualified for a government-sponsored loan modification or repayment plan through Fannie Mae or Freddie Mac the Federal Housing.

The lawsuit followed in the wake of allegations that the bank had opened millions of accounts on behalf of customers frequently without the customers knowledge or consent and in some instances. Wells Fargo Home Loan Class Action Lawsuit. Those with a Wells Fargo loan may be able to benefit from the settlement if between 2010 and 2018 they met the following criteria.

The lawsuit alleges that between 2010 and 2018 Wells Fargo miscalculated attorneys fees that were included for purposes of determining whether a borrower qualified for a trial loan modification under the US. Wells Fargo Co. Wells Fargo has agreed to pay 480 million to settle the securities class action lawsuit arising from the companys fake customer account scandal.

For example if you have an auto loan with Wells Fargo you might be eligible for a refund of unnecessary insurance premiums. Those with a Wells Fargo loan may be able to benefit from the settlement if between 2010 and. The denials are due to Wells use of proprietary software Black Knight to evaluate applications.

American financial services company Wells Fargo is the fourth largest bank in the United States based on assets. The company claims that it missed 874 applicants for home. And JJ Consulting LLC.

The financial corporation has found itself facing consumer backlash regarding alleged unfair operations of the bank potential unethical practices and more which have resulted in a range of class action lawsuits being filed. The settlement resolves. Agreed to pay 480 million to settle a class-action lawsuit in which investors accused the bank of securities fraud related to its fake-account scandal.

The Problem Behind the Wells Fargo Auto Insurance Class Action Lawsuit Details About the Class Action Lawsuit. In March 2017 Wells Fargo announced that it agreed to a 110 million settlement in the lawsuit before increasing the settlement from 110 million to 142 million to cover anyone who had a fake. In some cases you may receive a settlement for the costs of.

We along with Gibbs Law Group in Oakland California filed a class action lawsuit against Wells Fargo Home Mortgage for wrongfully denying mortgage modifications to homeowners in need. The money you receive will depend on how much the bank overcharged you.

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Every Wells Fargo Consumer Scandal Since 2015 A Timeline

Best Bikes And Cycling Guide 2018 Motorcycle Chopper Bike Cool Bikes

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VNXRSJJOJFPMDJ3A2QD5F75K5A.jpg)

Wells Fargo Wary On Prospect Of Asset Restriction Easing Reuters

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Wells Fargo Home Loan Class Action Settlement Top Class Actions

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

Drdo Ceptam 8 Recruitment 2016 1142 Technical Asst Admin Allied Posts Apply Online With Images Recruitment Online Organization Organisation Name

Wells Fargo Paying 3 Billion To Settle U S Case Over Illegal Sales Practices Npr

Juelz Santana S Home To Be Foreclosed By Bank While He S In Prison Report Prison Foreclose Reality Tv

Walmart Pharmacy Technician Job Description Key Duties And Responsibilities Pharmacy Technician Job Description Good Customer Service Skills

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

Wells Fargo Is A Hot Mess It Has Only Itself To Blame Cnn Business

Citi And Hilton File For Divorce Creditcardreviews Com Divorce Divorce Help Failed Relationship

Pin By Marlene Robinson On Believe It Or Not Finance Wells Fargo Janet Yellen

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

Wells Fargo Wary On Prospect Of Asset Restriction Easing Reuters

Wells Fargo Agrees To Settle Auto Insurance Suit For 386 Million The New York Times